ROLE

- User Research + Testing

- User Flows

- Sketching

- Wireframing

- Rapid Prototyping

DURATION

- 1-Week Sprint

TEAM

- One

TOOLS

- Pen + Paper

- Adobe Illustrator

- proto.io

DELIVERABLES

- Clickable Prototype (Medium-Fidelity)

Role

- User Research + Testing

- User Flows

- Sketching

- Wireframing

- Rapid Prototyping

Team

- One

Duration

- 1-Week Sprint

Tools

- Pen + Paper

- Adobe Illustrator

- proto.io

Deliverables

- Clickable Prototype (Medium-Fidelity)

Brief:

My classmate Stephen often has trouble tracking the various means in which his bills are paid. He also checks his mail infrequently, sometimes missing or forgetting paper bills. Because he has young children, it’s not uncommon to receive unexpected “one-off” bills from doctor’s offices, etc. in the mail, which he fears may fall off his radar. For my first student project, I was tasked with designing a concept that directly addresses Stephen’s problem.

My Solution:

An app that allows users to manage paper bills by implementing:

- Photo or manual data upload

- Integration with online payment platforms

- A countdown system that tracks users’ time until consequences of nonpayment (e.g., credit impact, late fee, etc.)

Research

User Diary

After our initial conversations, I asked Stephen to self-document his bill management over the last 1–2 months in a brief log, so I could get a better understanding of his problem. Lucky for me, Stephen was very diligent in his documentation, which provided a lot of information to play with. I ended up creating a quick topic map to help me visually sort it all out.

In-Depth Interviews

Although my topic map ended up being a hot mess, it helped me construct questions for my discussion guide, which I used as a reference as I conducted user interviews. I then completed a total of three 30-minute interviews- one more with Stephen, and two with other 20–30-somethings who had expressed similar concerns about their bill paying habits.

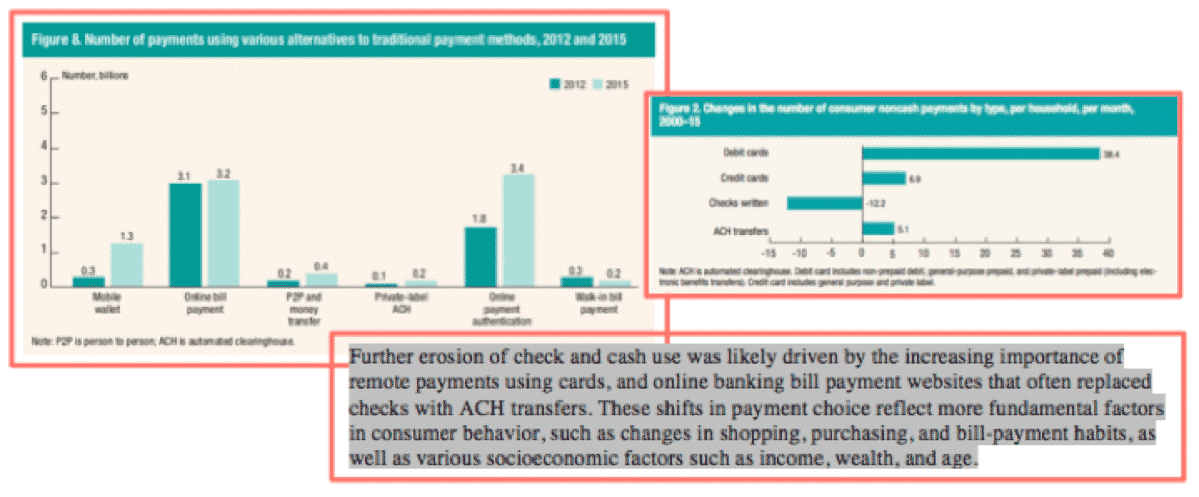

Supplemental Data

Because I was only able to interview three people (not ideal), I decided to use some additional resources to make sure I was making informed decisions. I consulted The Federal Reserve Payments Study (2016 study from the Federal Reserve Board), which addressed current trends in bill payment habits and commonly utilized platforms. My big takeaway from this was (predictably), that Americans are paying most personal bills via debit/credit cards, and veering away from writing checks. Online-friendly payment methods overall (through cards, ACH) are continuing to rise as popular methods for bill payment.

Synthesis

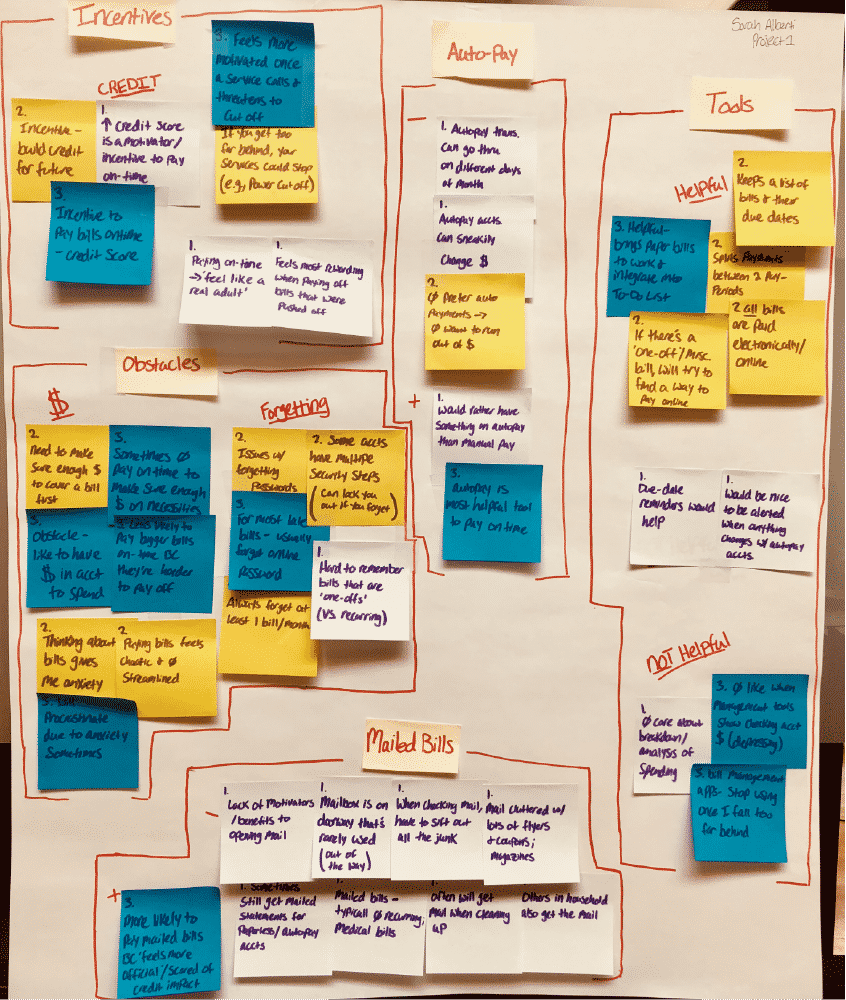

Affinity Mapping

I then created an affinity map to help visualize all the data I had collected form interviewing. From here, it was easier for me to see any emerging trends, etc., to derive my insights.

Insights

Some of the biggest obstacles towards on-time bill payment included forgetfulness & allocating money between accounts. Moreover,

- Checking mail & sorting bills was perceived as a significant hassle (too much junk; on-the-go; etc.), and commonly pushed aside.

- Users who had tried finance management/budgeting apps ultimately stopped because they did not like to see their spending breakdown (felt “shaming”; “depressing”)

A BIG motivator for all users, however, was building/maintaining good credit.

Solution

Design Principles

The most interesting thing I noticed was the dissonance between people’s motivation to build/maintain good credit and their lack of motivation to address paper bills in the mail, given that the two are pretty directly related. I decided that my solution need to do something to bridge this gap. Particularly,

Solutions should:

A. Help users keep track of their paper bills by allowing a quick & convenient way to document and sort articles received in the mail

B. Motivate users to pay bills by reminding them of potential credit impact (or other negative repercussions of nonpayment)

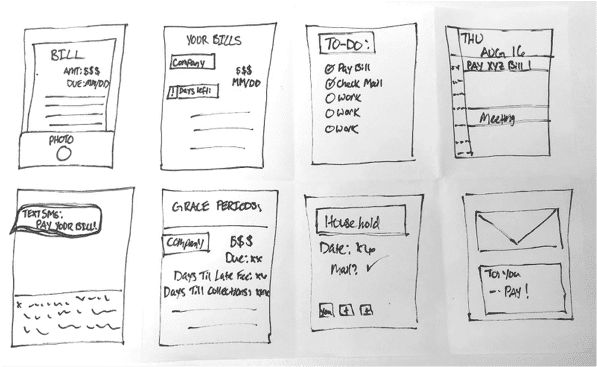

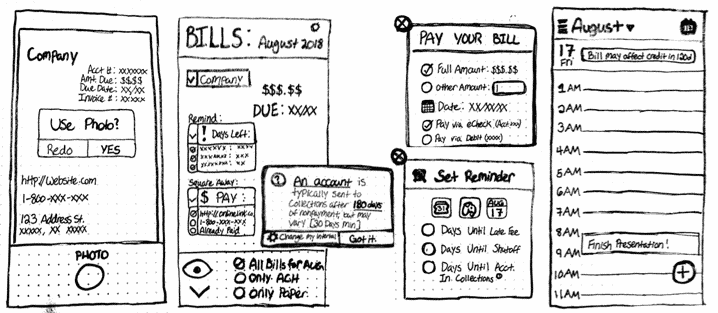

Sketching

Once I had a better idea of what the solutions should address, I started the sketching process by doing some crazy 8’s (just to get some ideas flowing). Because Stephen (and the others I had interviewed) had mentioned being on-the-go as a recurrent pain point for sorting through and remembering their mail, I decided to focus my ideation around a mobile app. I then picked a few ideas I thought had some legs and sketched out some rough wireframes for each. I completed some concept testing with Stephen, and through that, picked 3 main concepts I thought most effectively addressed my design principles:

- A photo or manual data upload of users’ paper bills

- Integration with online payment platforms

- A countdown system that tracks users’ time until consequences of nonpayment (e.g., credit impact, late fee, etc.)

Prototyping

Before making my digital prototype, I also wanted to complete at least one round of usability testing with others, including Stephen. Because this was a 5-day sprint, I decided to just make a paper prototype first (to make sure I wasn’t married to anything before testing it out). I cut out some (slightly more detailed) sketches and went through the user flows, which consisted of one task for each of the 3 concepts. After collecting feedback, it became clear that many wanted to view all of their bills on the same platform (not just the paper ones). For my final iteration, I included the ability to manually enter in information from recurring bills, and then added the option to sort/filter by the types of bills listed on the account, which I quickly incorporated into the sketch (mainly so I’d remember to do this when making my digital prototype).

Copyright © 2022 Sarah Alberti